Oracle Announces Upcoming Cloud Compute Instances: Ice Lake and Milan, A100 and Altra

by Ryan Smith on September 22, 2020 6:00 PM EST

When the name “Oracle” is thrown around, hardware isn’t typically the first thing that comes to mind for most people. But, like other large tech companies that originally made their mark in the world with software, the market for Oracle has grown beyond just companies needing software and SPARC boxes. And as a result, Oracle has spent the last few years increasingly investing in cloud infrastructure hosting, looking to pivot towards becoming a service provider for customers who are becoming increasingly accustomed to contracting out virtually every bit of their computing needs.

Today Oracle is taking the next step towards growing their footprint in the cloud computing market by announcing their next generation of compute instances for their Oracle Cloud Infrastructure (OCI) business. In an atypically high-key event that included the CEOs from no less than AMD, Ampere, Intel, and NVIDIA, Oracle announced that they will be providing computing instances based on new and upcoming processors from all four companies. This not only includes updated systems based on AMD and Intel’s forthcoming EPYC Milan and Ice Lake Server products, but also NVIDIA’s A100 accelerator. And, for the first time for Oracle, there are also plans for Arm-powered instances using Ampere’s Altra processors. Overall, these new instances will be significant jump in hardware for Oracle, and one that’s part of a larger effort to vault into the top echelons of the cloud computing market.

While the market for cloud computing hosting is still relatively young even by rapid tech industry standards, it’s a market that’s quickly come to be dominated by a handful of players – particularly Microsoft (Azure), Amazon (AWS), and Google. The rapid adoption of cloud computing has caught the major players off-guard– at times leaving them struggling to build datacenters quickly enough – but also making them very successful in the process. For Microsoft and Amazon in particular, their cloud computing profits have quickly become a cornerstone of their quarterly earnings, overshadowing some of their more traditional business. In other words, cloud computing has become a growth opportunity (and a highly profitable one at that), and Oracle wants a piece for themselves.

As I mentioned earlier, Oracle isn’t brand-new to the cloud infrastructure game. But the company has needed time to grow, both to better understand the market and to figure out how to best meet customer needs. As a result, it’s only now after almost four years in that Oracle is really hitting the pavement on promoting their cloud services, hosting high-profile presentations, pre-briefing the press, and taking other steps to get their name out in the market. Oracle is in the midst of transitioning from being a database company to a cloud services company, and today is intended to be the inflection point where that transition hits its stride.

Hardware From All: x86, Arm, & GPU

Spearheading this latest phase for Oracle’s Cloud Infrastructure business is a new generation of compute instances, based on processors from vendors across the board. Along with updating their offerings to include the latest x86 processors from AMD and Intel, Oracle is also preparing to launch their first Arm-powered instances based on Ampere’s Altra processors. And of course, on the GPU side of matters Oracle is introducing systems and instances using NVIDIA’s A100 accelerator. In short, Oracle is rolling out the latest and greatest in compute hardware to woo other cloud customers, keep up with the competition, and otherwise entice traditional (on-premises) customers that it’s time to come to the cloud.

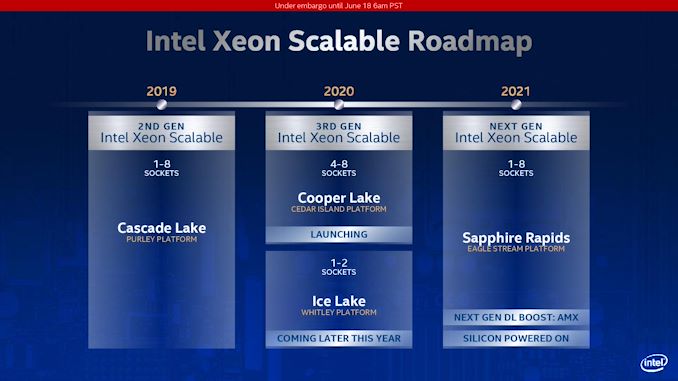

For OCI’s traditional CPU-based compute instances, the company is gearing up to launch updated instances with hardware from both Intel and AMD. OCI already offers instances based on Intel’s Cascade Lake Xeon and AMD’s EPYC Rome processors, and going forward the company is continuing to offer systems based on both vendors’ hardware.

On the Intel front, Oracle is preparing new Ice Lake Server instances, which will be launching next year as Oracle’s high-performance compute-focused X9 instances. Although Intel has largely kept Ice Lake Server details under wraps since the hardware has not yet officially launched, Oracle and Intel are already touting performance gains as high as 30% on some workloads versus their current Skylake-based X7 HPC instances.

Meanwhile not to be outdone, OCI is also preparing new E4 general computing instances based on AMD’s upcoming EPYC Milan processors. Similar to Intel, AMD hasn’t said a whole lot about what to expect from their upcoming Zen 3-based server processors, though with Rome already pushing 64 cores in a single chip, we’re expecting Milan to instead focus on improving per-core performance.

Early next year OCI will also be adding Ampere Computing’s wares into the mix. Oracle will be launching its first Arm-powered instances, becoming the latest cloud provider to incorporate Arm into their compute offerings, following Amazon’s interesting Graviton family of instances. OCI’s Arm instances will offer up to 160 core configurations based on Ampere’s Altra processors, which in turn is based on Arm’s surprisingly potent Neoverse N1 architecture. OCI’s Arm instances will clock as high as 3.3GHz, and Oracle will be positioning them as a cost-effective option for customers who need a lot of cores, but not necessarily maximum single-threaded performance.

Finally – and more immediately – OCI is refreshing its GPU compute instances. The company’s current P100/V100 instances are being joined by instances based on NVIDIA’s new A100 accelerator, the latest and greatest from the company. The Ampere architecture-based accelerator (not to be confused with the other Ampere) will be available in system configurations of up to 8 GPUs per node, with OCI offering clustered options as well to scale that out to 512 GPU clusters. Also of note, OCI is equipping their nodes with 2TB of RAM, twice as much as the 1TB found in NVIDIA’s DGX A100 boxes. And unlike all of the new CPU instances, which launch next year, the new A100 instances will hit general availability next week, on September 30th.

Growing the Base: Bare Metal and Other Clients

With their new compute instances set to come online over the coming weeks and months, Oracle is setting out to further grow their customer base. Being competitive is certainly a part of that, and rather unusually for Oracle, that includes competing on price. For example, Oracle expects their A100 instances to be the cheapest on the market at $3.05 per GPU hour, and their AMD/Ampere CPU instances are being similarly positioned for cost-effectiveness. So it makes for an interesting state of affairs for the cloud computing market when the traditionally (if not notoriously) profit-focused company is working to become a price leader.

Though while competing with the other major cloud providers is a concern for Oracle and a driver behind these upgrades, it’s not the only factor in Oracle’s cloud offerings. The cloud computing market is still a growing market, and that’s largely because traditional server customers are still in the process of transitioning over to cloud infrastructure. It’s these customers that Oracle is taking a particular interest in – rather than just winning over customers from other providers – to entice them to move their on-premise workloads into Oracle’s datacenters.

But traditional customers are traditional for a reason; while some are merely uninterested in change, others have workloads and use cases that don’t always map well to cloud computing paradigms. Meaning that in order to bring these customers into the fold, Oracle needs to figure out how to solve the “hard stuff” that keeps customers’ computing in on-premises servers and workstations. The low-hanging fruit there is performance, particularly in being able to deliver the kind of performance that customers need so that they can do everything in the cloud and without the benefits of quick uploading and downloading to local hardware.

Meanwhile other roadblocks are things like hardware control, with customers being accustomed to having hardware they can control virtually every aspect of, as opposed to the more abstract, plug-and-play nature of virtual machines and containers. Which is why a big focus of OCI’s efforts (and a major differentiating factor for them) is on their bare metal systems. True to the name, these systems are setup without virtualization and offer customers low-level access to the hardware, including BIOS settings as necessary. For containerized applications it’s completely unnecessary, but for traditional applications and legacy programs that have never been run on anything but bare metal hardware, it offers a more direct route to transitioning towards cloud hosting.

But the real trick, as always, is convincing those traditional customers to make the leap; simply having a hardware offering only goes so far, no matter how solid it is. Which is why Oracle’s efforts in the cloud computing space are as much about marketing as they are technology, and why Oracle is also rolling out use case studies, testimonials, and such, in order to bolster their claims. There’s even more money to be made in the cloud infrastructure business – avenues that AWS and Azure haven’t been able to fully tap thus far – but to reach them, Oracle has to be able to do the things that other cloud competitors cannot.

At any rate, Oracle’s new compute instances will be rolling out in two phases. Their new A100 GPU instances will be available next week. Meanwhile the bigger shift to new CPU instances will take place next year, with Intel’s Ice Lake Server, AMD’s EPYC Milan, and Ampere’s Altra processors all become available.

Source: Oracle

16 Comments

View All Comments

drexnx - Tuesday, September 22, 2020 - link

I wonder if you can make more than $3.05/hr crypto mining on an A100....Dusk_Star - Wednesday, September 23, 2020 - link

If you could, it would drive the difficulty up such that $3.05/hr was just at breakeven.Arsenica - Tuesday, September 22, 2020 - link

" For example, Oracle expects their A100 instances to be the cheapest on the market at $3.05 per GPU hour"As this is Oracle I have the feeling that there will be hidden fees. Like acquiring a license to unlock each Tensor core being used.

GreenReaper - Tuesday, September 22, 2020 - link

The big three underestimate Oracle at their peril. They've put serious work into their cloud platform, and they have a free offer that in many ways (notably transfer and storage speed) outclasses the competition - and which is getting developers and administrators like myself to try them out.Whether that translates into purchases is unclear, but it's a number's game; they clearly want to be at the table, and they're pouring a lot into setting up datacenters round the world to make it happen.

senttoschool - Tuesday, September 22, 2020 - link

Oracle has an advantage over Amazon and Oracle in the enterprise cloud because they serve so many enterprise customers already. The enterprise trusts Oracle, but they might not trust Amazon or Google. Microsoft is also trusted by enterprises.However, I highly doubt that startups will choose to use the Oracle cloud because Oracle just doesn't know how to build and market products for small companies like Amazon and Google do.

Teckk - Wednesday, September 23, 2020 - link

AWS is the current leader, Microsoft second. I'm sure enterprise doesn't run on "trust".duploxxx - Wednesday, September 23, 2020 - link

Oracle and there licensing whoos (Oracle DB, java, ....) and you really think Enterprises still "trust" Oracle... far from.GreenReaper - Wednesday, September 23, 2020 - link

To an extent, yes. I felt a certain tension dealing with the bureaucracy of support requests. Also having to try repeatedly over a month to get instances in Brazil (admittedly an exotic region).However, startups work with what they can get. If they get a good offer from Oracle, they'll use it. Many products are standardized now and finding the options is a short search away.

mpschan - Wednesday, September 23, 2020 - link

I don't know a single person with exposure to Oracle and their licensing/audit practices that would touch anything sold them. None. I wouldn't spend a penny using compute time from Oracle for fear I'd somehow owe them $1000 at a later date.The only good thing that might come out of this would be pricing pressure on others.

FXi - Wednesday, September 23, 2020 - link

Exactly. Oracle is quickly becoming almost the last party many would prefer to deal with.